north carolina estate tax exemption 2019

It later turned around and repealed the tax again retroactively to January 1 2013. The NC Community College System is the recipient of a 2019-20 Innovation of the Year Award for a program that.

State Taxes On Capital Gains Center On Budget And Policy Priorities

6783 centsgallon Includes all taxes Cigarette Tax.

. And 300000 in Sales Tax Exemption from NC Department of Revenue. Click here to read about key votes made by Tillis. The estate tax rates in.

Due to COVID in Wake County and North Carolina the Secretary of States Office is not accepting any new in-person appointments EXCEPT FOR APOSTILLES and OTHER AUTHENTICATIONS which require original documents. The mission of the Harnett County Tax Department is to provide fair and equitable appraisal assessment billing and collection of taxes on real business and personal property in Harnett County. His current term ends on January 3 2027.

The 18 counties of North Carolinas Southeast Region offer an ideal business location for companies of all shapes and sizes to succeed in the global marketplace. Revenue from property taxes is used to fund public schools emergency services public libraries and other county and state services made available to the public. 2021 Health Savings Custodial Account.

40 food prescription and over-the-counter drugs exempt. NEW YORK Sales Taxes. North Carolina offers a property tax homestead exemption of 25000 provided that the person over 65 meets certain criteria.

Tax rates can be above and below these numbers. This notice lists both vehicle registration fees and. As in North Carolina South Carolina does not tax Social Security benefits.

Tennessee repealed its estate tax in. The Land Records Division of the Durham Tax Administration Office is responsible for the following. Search for refunds and learn more about the Treasurers Black Latino Houses Matter program by calling the Treasurers Office at 312 603-5105 or visiting cookcountytreasurer.

2021 Coverdell Education Savings Custodial Account. 6152 centsgallon Includes all taxes Diesel Fuel Tax. The aim of a grocery exemption is to reduce tax burdens.

2021 Roth Individual Retirement Trust Account. 2021 Coverdell Education Savings Trust Account. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

However there is a huge difference when it comes to property tax. New York City adds 150 Personal Income Taxes. Tillis Republican Party ran for re-election to the US.

Download a copy of the Real Estate Property Tax Exemption or Exclusion Application. Lenoir County Tax Department Phone. Senate to represent North CarolinaHe won in the general election on November 3 2020.

In this category South Carolina is the. Both the exemptions cannot be received. According to the National Retail Federation Halloween shoppers plan to spend 26 billion on candy in 2019a whopper of a number.

In cases where the owner qualifies for both age 65 and disabled exemption the homeowner can choose only one among the two for the school district taxes. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. The Tax Department is committed to excellent customer service and to fair and timely tax administration as guided by the North Carolina General.

Most filings and transactions can be completed online or by mail and we. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain public service workers including teachers law enforcement officers emergency medical personnel active duty members of the military and Florida National Guard and child welfare service employees. New Jersey phased out its estate tax in 2018.

Additional exemptions are available for. Qualifying homeowners can deduct 39300 for 2019-2020 from the assessed value of the applicants home and property taxes are computed based upon the remaining assessment Louisiana. NO NEW IN-PERSON APPOINTMENTS EXCEPT AUTHENTICATIONS.

Identification of real property ownership for listing and taxation. The tax rate as of 2019 typically starts at 10 and then increases in steps up to about 16. In South Carolina there is an annual property tax on real estate that is a major source of revenue for counties and the state.

The states homestead exemption allows the first 50000 of a propertys fair market value to be exempt from local. Age 65. In other words.

In 2013 North Carolina repealed its estate tax so youre free to choose from either one of these states. Property tax bills are calculated by. Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming.

Homeowners qualify for a 10000 homestead exemption in addition to the 25000 for school districts. 101 North Queen Street Kinston NC 28501. North Carolina now combines your vehicle registration fees and property taxes into one renewal notice.

He assumed office on January 3 2015. Both the annual tax renewal and property tax will be paid to the North Carolina Department of. Cities and counties may add up to 4875 in additional sales tax.

If you think you and your mortgage company both paid the taxes for the same installment resulting in a double payment you may be eligible for a property tax refund. Thom Tillis Republican Party is a member of the US. Senate from North Carolina.

A A use tax is imposed on the storage use or other consumption in this State of tangible personal property purchased at retail for storage use or other consumption in this State at the rate of five percent of the sales price of the property regardless of whether the retailer is or is not. About sixty 60 days before your vehicle registration expires the North Carolina DMV will send a renewal notice to the address on record. Qualifying homeowners can get a tax exemption up to 75000 for their primary residence.

In addition to real property ownership maintenance and GIS mapping the Land Records Division processes exemption applications in accordance with North Carolina General Statutes. Credit for tax paid in another state. Before 112019 112019 - 12302020 112021 - 12312021.

Buncombe County Budget in Brief FY 2019 A quick overview of where money comes from where the money goes for Buncombe County Governments Budget. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. This process is known as Tax Tag Together.

Estate tax rates are typically assessed in brackets after the exemption threshold like income tax is assessed.

U S State And Local Sales Tax Revenue 1977 2019 Statista

Default Transition And Recovery 2019 Annual Global Corporate Default And Rating Transition Study S P Global Ratings

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Fall Getaways Aurora Inn And E B Morgan House Aurora Ny Hudson Valley Magazine Photograph Courtesy Of E B Morgan House Getaways Travel Luxury

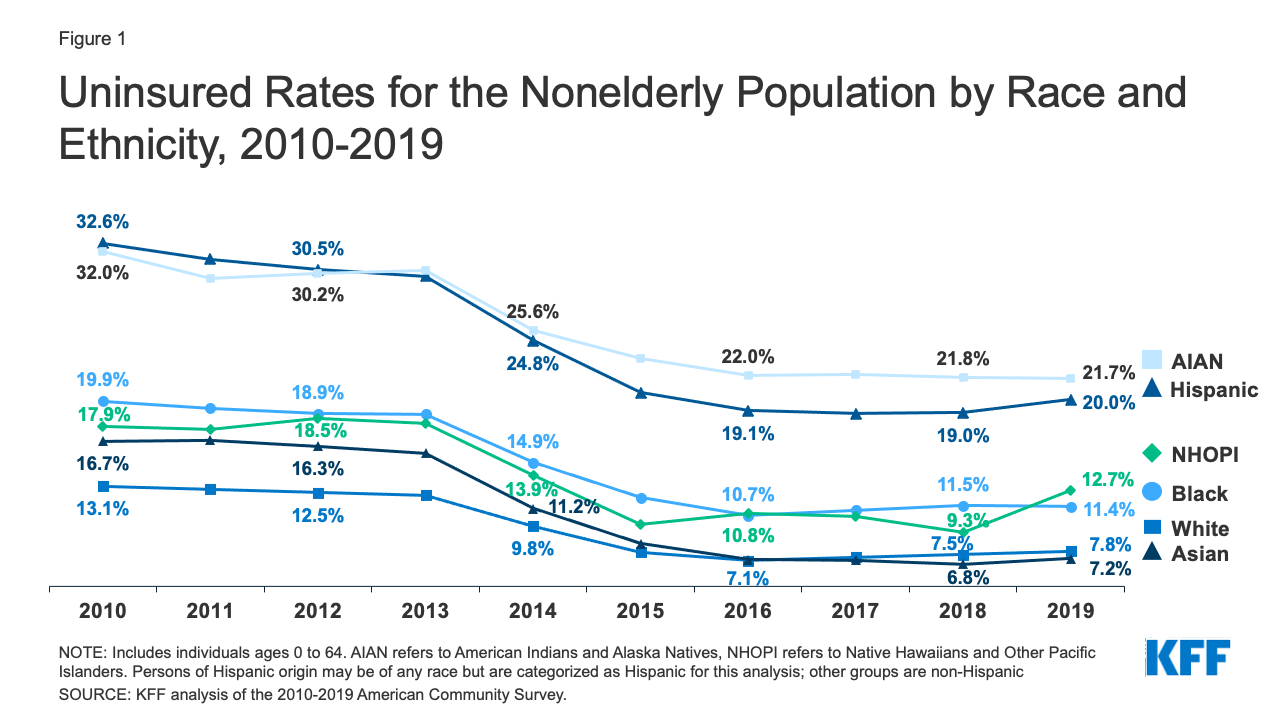

Health Coverage By Race And Ethnicity 2010 2019 Kff

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

State Taxes On Capital Gains Center On Budget And Policy Priorities

Selling Your House Nolo S Essential Guide Hamilton North Public Library Selling Your House Buying Your First Home Being A Landlord

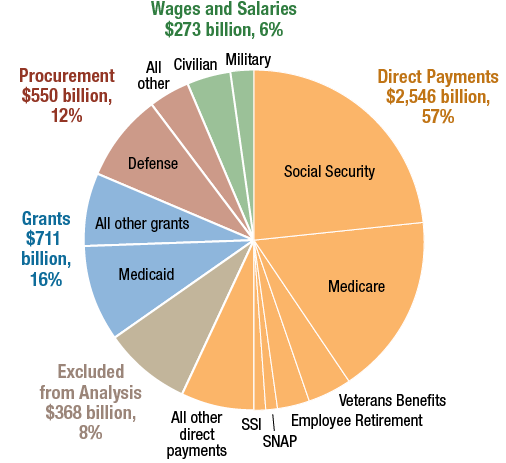

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

New York S Balance Of Payments In The Federal Budget Federal Fiscal Year 2019 Office Of The New York State Comptroller

Preparing Tax Returns For Inmates The Cpa Journal

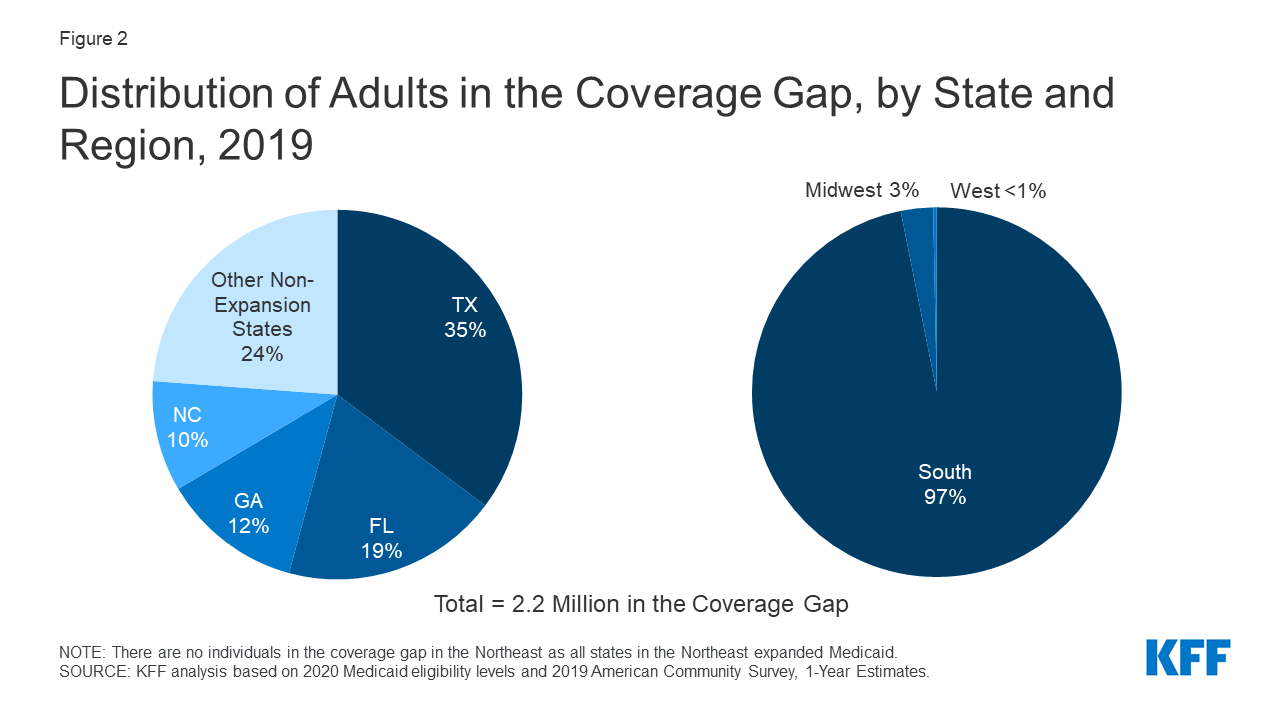

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff