carried interest tax uk

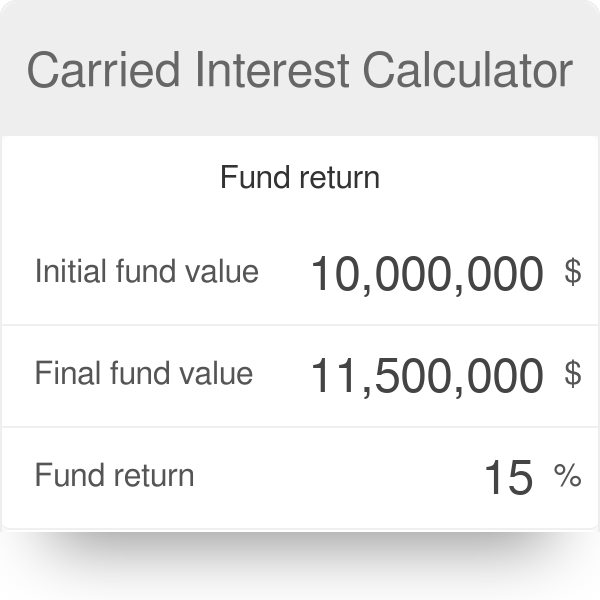

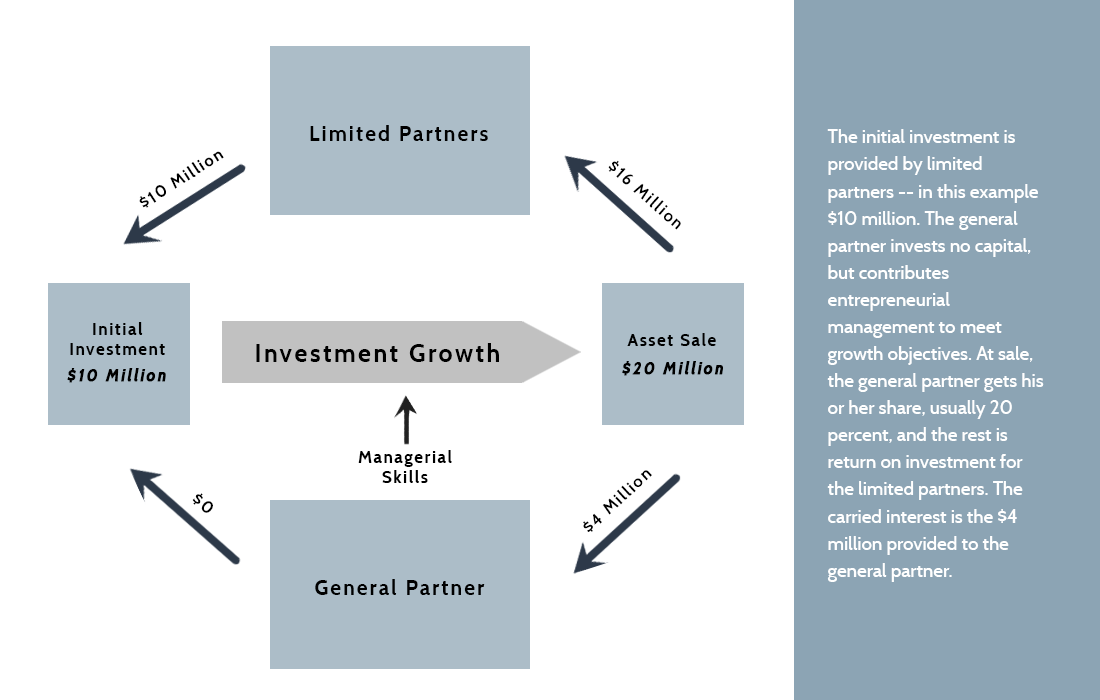

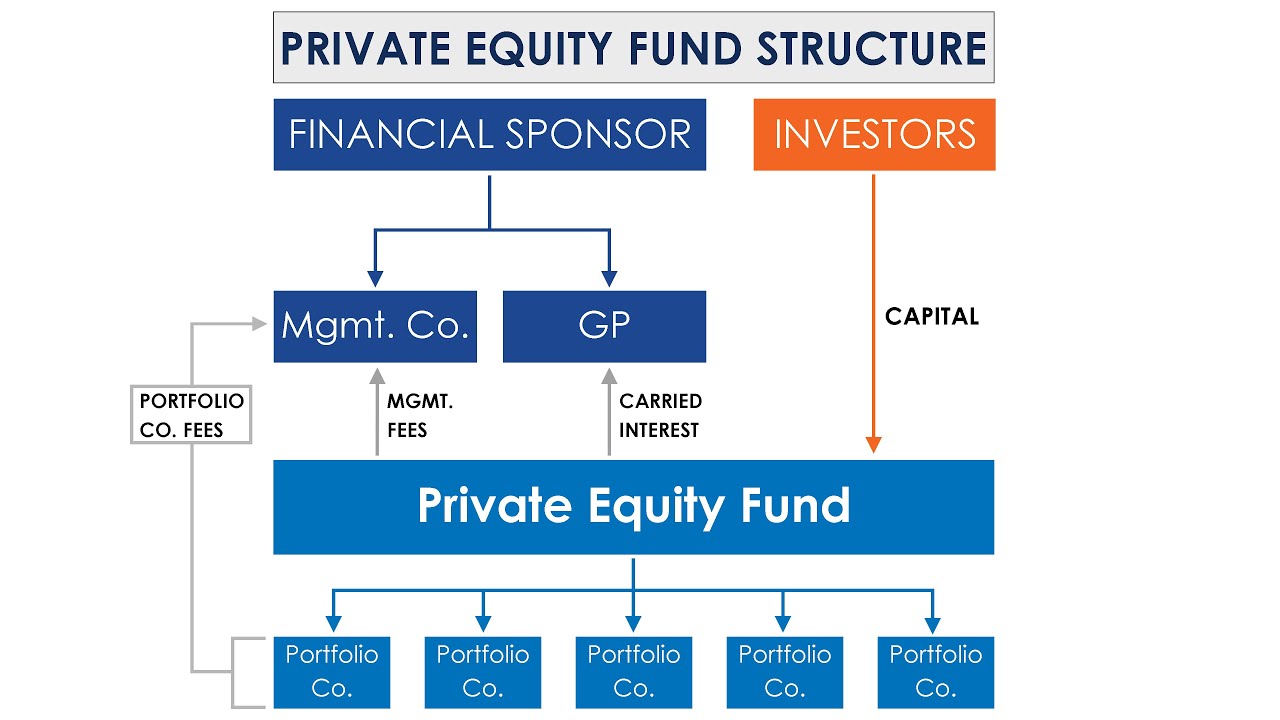

See recent article on UK Budget 2021 The rules on the tax treatment of carried interest are complex. Carried interest also referred to as the carry which might entail 20 of the funds profits over a set period typically annual with the exception of private equity funds.

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

Carried interest is a contractual right that entitles the general partner of an investment fund to share in the funds profits.

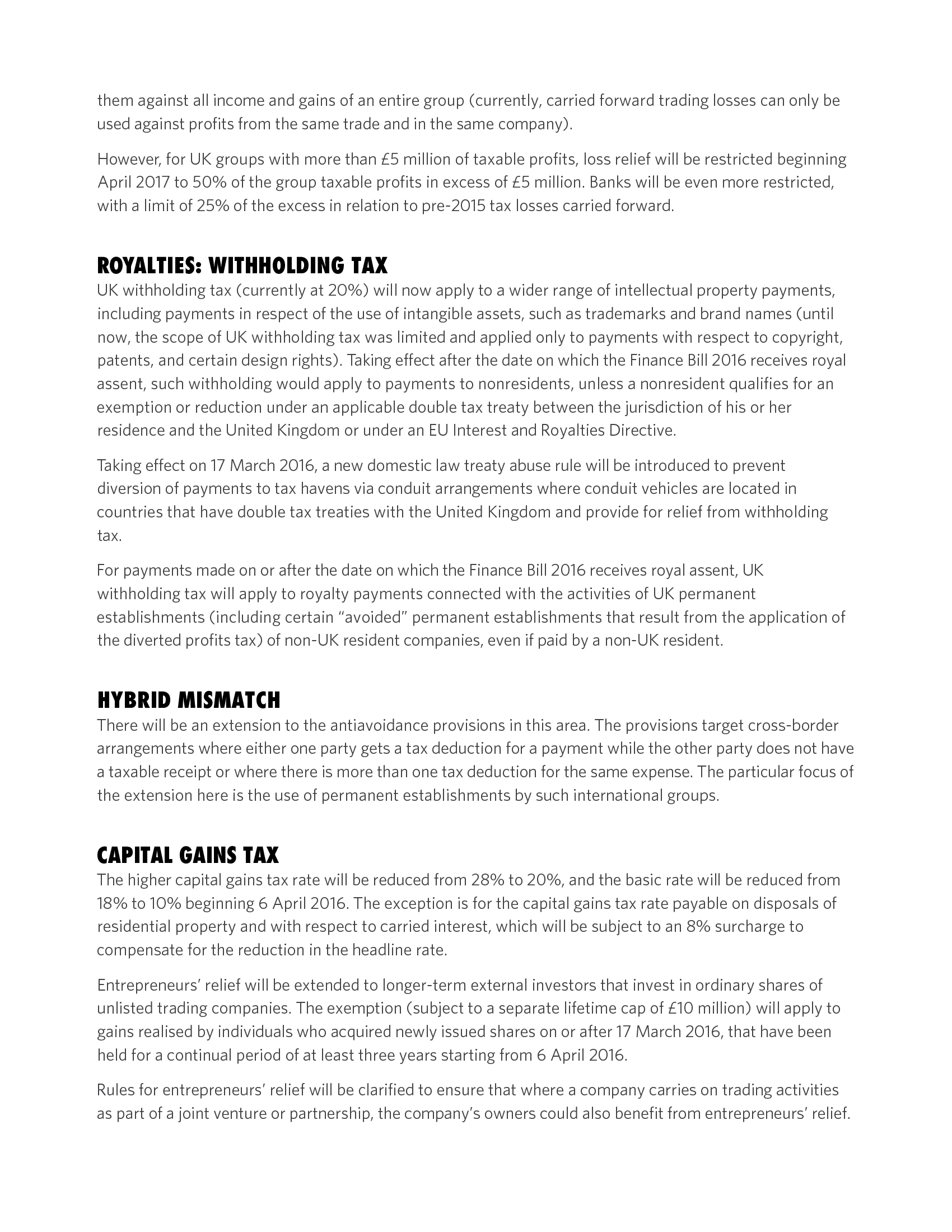

. The UK resident. 10 and 20 tax rates for individuals not including residential property and carried interest. Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid income tax.

An investment manager generally receives fees linked to the value of assets under management. 28 capital return 453935 income return 238 long term capital gain 403 income return State taxes may also apply. New clauses are inserted by Finance Act 2016 which aim to beef up the tax charged and ensure that investment.

This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. The following Capital Gains Tax rates apply. In light of the news that a Labour government would crack down on the private equity industry by ending a loophole that allows executives to pay a reduced rate of tax on.

Carried interest is received by a UK resident company. Ad Browse Discover Thousands of Business Investing Book Titles for Less. 30 pages Ask a question Carried interest.

Tax rate on the carried interest just 28. Carried interest is a term used to describe the slice typically 20 of super profit profit in excess of a hurdle generated on alternative investment funds which is payable to the. Carried interest now falls into one of two categories.

Short holding period of assets. Tax Practical Law UK Practice Note 6-596-5847 Approx. 18 and 28 tax rates for individuals.

Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is. From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be. These funds invest in a wide range of assets including real estate.

In principle annual fees have been subject to income tax but carried interest. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they. The legislation provides that chargeable gains on carried interest arising after 8 July 2015 are foreign gains to the extent that the individual performs the relevant investment.

Avoidance of double taxation 1 This section applies where a capital gains tax is charged on an individual by virtue of section 103KA in respect of any carried. And that planning. The introduction of the Disguised Investment Management Fees DIMF.

The carried interest tax charge is however deferred where the individual is genuinely unable to access the cash due to a commercial deferral arrangement which has been. Relief will only be available if the other tax paid is directly relatable to the carried interest amount received.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DCYDKFTNRNP3DPHSEWGG4UD2UM.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

How A Carried Interest Tax Could Raise 180 Billion The New York Times

Private Equity Fund Structure A Simple Model

Carried Interest Uk And Us Developments

How Does Carried Interest Work Napkin Finance

Advisorselect Uk Tax Measures Spring 2016 Budget March 17 2016

Analysis Of The Impact Of Increasing Carried Interest Tax Rates On The U S Economy Part I Center For Capital Markets Competitiveness

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

Tax Considerations For Foreigners Investing In Uk Real Estate Htj Tax

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Capital Gains Tax Treatment Of Carried Interest Gov Uk

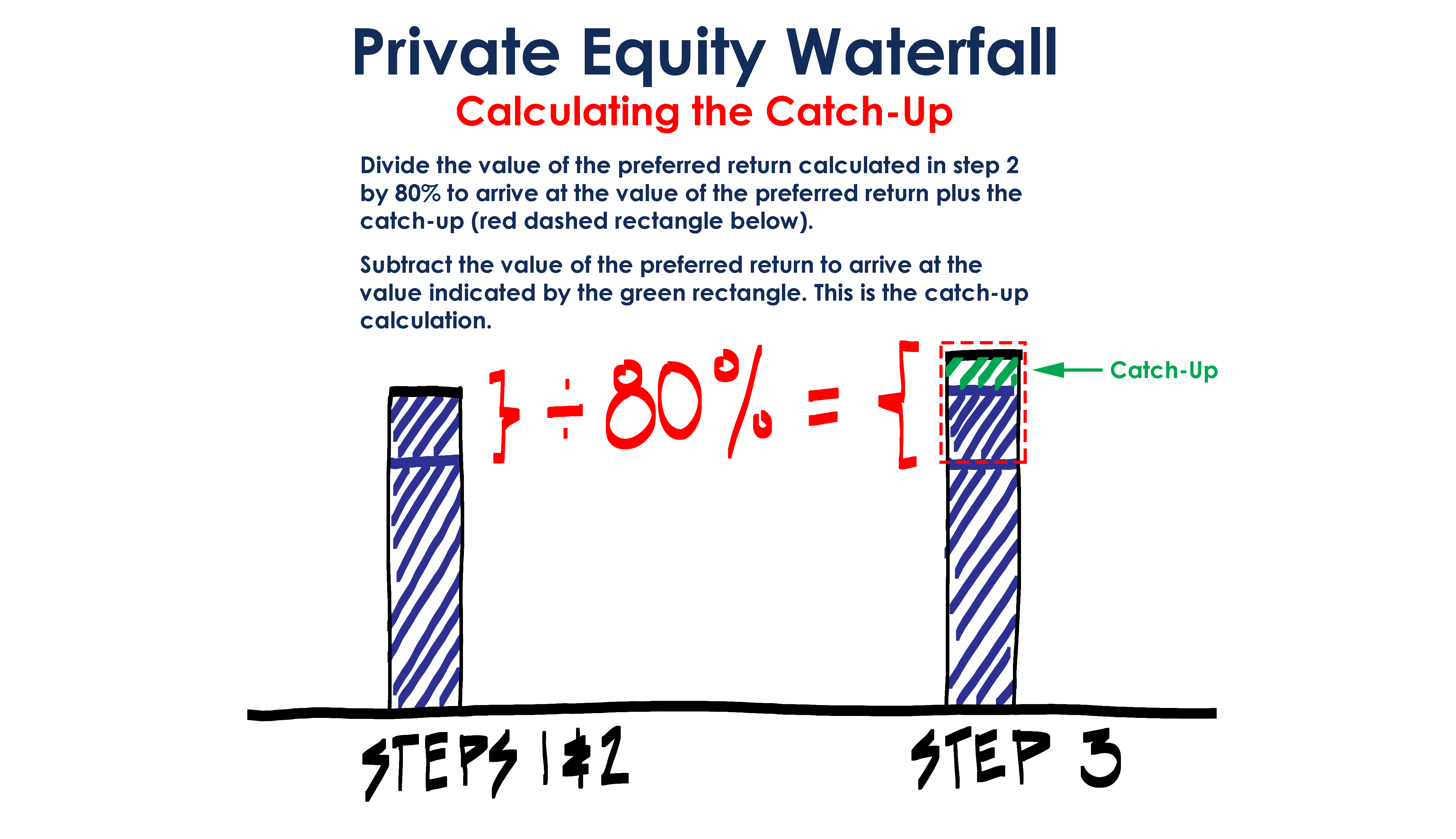

Private Equity Catch Up Calculation A Simple Model

Alvarez Marsal On Twitter Following The Recent Release Of Hmrc S Updated Guidance On Disguised Investment Management Fees And Carried Interest Rules A Amp M Taxand Have Reviewed The Updates And Provided A Summary

Asset Management Spin Outs To Llp Or Not To Llp That Is The Question Lexology

Eversheds Watch List For The Autumn Statement Publications Eversheds Sutherland